Budgeting Tips for Digital Nomads

I delivered a keynote last week at Bansko Nomad Fest to quite a full auditorium. I nervously assumed 3 people would show up but it turns out this was a popular topic! I’ll share the main points of my presentation as well as the slides. And if all went well with the recording, I’ll circle back and attach that here too.

Of course if you’d like to have a 1:1 on this, please reach out and schedule a meeting here:

Presentation

First a little about me, and why I am passionate about helping others:

Thinking about being “profitable” is important even with your personal finances. Most digital nomads are solopreneurs or freelancers so this is applies to both aspects.

Make it stand out

I break this down into four objectives - first and foremost is your mindset.

The second is skills, which you need in order to assess what your strengths and weaknesses are and build some self-awareness. I also put an amazing gif of Magic Mike, who’s got skillz (but not the kind we need for this…)

Next on the “pyramid” would be processes, aka how do we do this? Sheldon probably already knows the answer.

And lastly tools. But not that kind.

As a digital nomad, you will probably have some serious FOMO. Unless you' have unlimited funds, you’ll need to budget - and the best way not to overspend is first to assess your values. What is most important to you? That will probably be where you spend the most money. If you know what these are then you won’t spend money on everything - and you’ll feel better about what you don’t spend money on.

If you don’t mind a hostel, then you’ll probably be able to spend more on nightlife and experiences. If you need your own Airbnb, then perhaps pick only your 1-3 top experiences and do only those. Do you need extra money for extra luggage fees? Then perhaps make meals at home rather than eat out all the time. Figure out what’s most important to you.

When applying this objective with your personal finances, assess your own strengths and weaknesses. If you’re tech savvy and organized, for example, that will help a lot - but if you are also a procrastinator, then you’ll have to find a way to get yourself over that hurdle.

Find a way to reward yourself if working on your budget is challenging. Treat yourself with manicure if you get your budget done, schedule budget time on your calendar and mark as “busy” - find a way to make it a little easier for yourself. If you’re uncomfortable about money and feel emotional about it - journal about it? Talk to a money-wise friend? Scream in to a pillow? Once you figure out these out, you’ll be setting yourself for more chance of success.

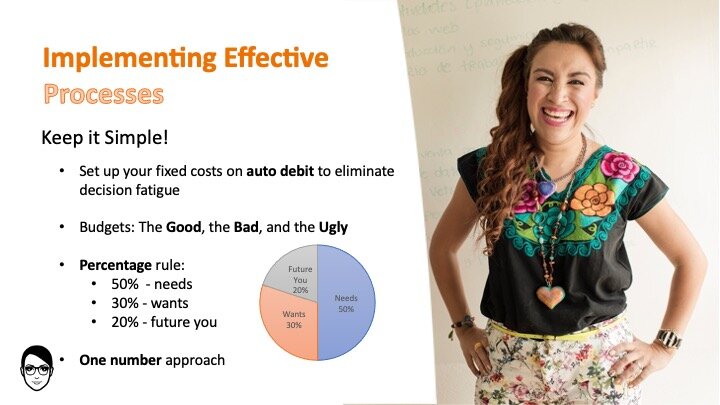

Processes - this is what most of you are waiting for, but it’s still 3rd on the list of how to approach this, so please do the foundation steps above first. They mantra here is to keep it simple - if you are a perfectionist (it me) or need to do some huge system, you’ll most likely abandon ship before being effective.

First, to eliminate decision fatigue - set up fixed costs on auto debit. Decision fatigue is real and will exhaust you before you get to the hard stuff.

Next, I highly recommend three budgets (make three tabs on Excel/Google Sheets) - one (the “good’) where your income is most that you would want, and perhaps even increasing each month. The next scenario (the “bad”) would be where if starts to decline or be less than ideal - here you’ll start to choose what expenses stay and what goes. Next (the “ugly”). This is where it’s awful and you’re looking at making sure the very basics are covered (#byenetflix). Knowing what these three look like will help give you an idea of what actually is needed in each one of these scenarios and keep you feeling prepared rather than uncertain and anxious.

Lastly, I want to touch up on a budget idea that is helpful for some - the “One Number” approach. (I don’t use this but some find it useful so want to share it just in case). In short this is where you figure out what your “extra” spending money is - that “one number” is perhaps $150 a week. Then you might put that in it’s own “allowance” account and that’s all you can spend.

Just touching upon a helpful concept by these two key words: first you make a budget, then you forecast as you go through the year using what actually occurs. To do this, you need to have a way to track your income and expenses. I highly recommend Xero , but however you do it - you need to capture what actually is spent and then you can analyze it.

Here’s an example (using Xero) where we create an Income Statement (also called a Profit and Loss) report. This shows income at the top (and then subtotals it) and expenses below it (and subtotals those). Then below that it subtracts what you spent from what you earned. Exporting this information and then making future forecasting with this information is key.

Utilizing a spreadsheet - you can adjust your anticipated income and expenses to make sure you’re spending within your means. Again - keep these categories simple as the more this list grows, the more overwhelming it is. Feel free to merge categories - the goal here is to see what you’ve been spending (usually a surprise when you look at what you’ve actually been spending) and use that as a benchmark for the future. $200 on Starbucks - like, whoa. Maybe investing in an espresso machine at home will save you money over the long run.

Lastly, the software is the LAST thing you think about. You do need to pick the right apps - but they are useless if you don’t have a great foundation (above). Below is an old slide I’d use for clients - but it shows an example of how one can utilize cloud-based apps to do the heavy lifting of your processes, and how they can integrate with each other if needed.

For personal finances, start simple - your bank and a decent accounting software, and a spreadsheet.

In summary - here’s the steps that I recommend.

I’m a big believer in incremental steps EACH day will result in progress. It might take you 6 months to get the hang of this - but keep putting it on your To Do list, book a meeting with me, google and research more - just keep at it. Your next-year self will thank you!

And of course feel free to contact me. I’m also a digital nomad myself and you can follow my travels on Instagram at @kirsten.wandering Safe travels and happy budgeting! - Kirsten